Betting on Building: The Venture Capital Opportunity in AEC Technology

A Deep Dive into AEC Tech’s Venture Capital Ecosystem

Why AEC Tech Matters

Architecture, engineering, and construction—or “AEC” as we call it—is far from a new industry. In fact, it’s considered one of humanity’s oldest professions. For as long as people have existed, we’ve been building—it’s simply part of our nature. This long history explains why AEC has such a massive global market across virtually every country. Coupled with this large scale, steady growth, and relative stability, the industry is ripe for technological advancements that streamline its many processes.

Software is said to be “eating the world” by optimizing workflows across virtually every business sector. From modern industries like human resources to more traditional fields such as agriculture, software is guaranteed to improve efficiency. Investors have poured enormous sums into software development, chasing growth and investment returns once considered unthinkable. In fact, over the last 25 years, nearly $4 trillion has gone into software-focused venture capital, with an annual average of about $200 billion in the past decade alone.

Given AEC’s vast market size and software’s disruptive scalability, how appealing is this space for venture investors? What sort of returns can they expect, and is the “juice” truly worth the “squeeze” in such an established industry? In this piece, we’ll examine whether AEC tech offers compelling opportunities compared with other verticals and whether now is the right time to invest.

Current State of Venture Capital in AEC Tech (As of January 2025)

The past five years have been turbulent for the tech sector as a whole. We experienced the boom of the COVID-era economy between 2019 and 2021, followed by the high-interest, layoff-prone environment from 2022 to 2024—truly a rollercoaster. AEC tech has been no exception, tracking these macroeconomic shifts much like other software verticals.

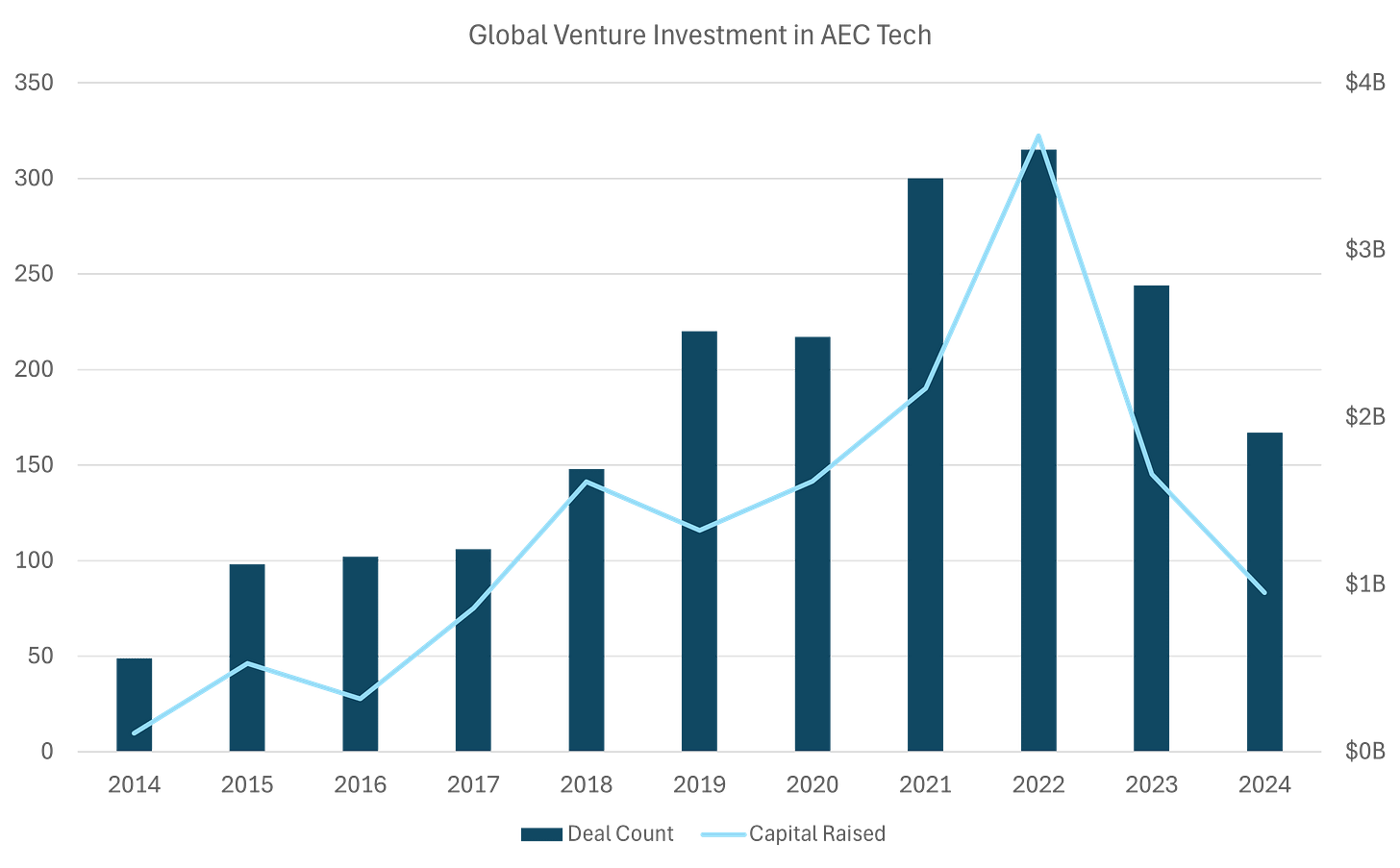

In both 2021 and 2022, annual venture capital in AEC tech surpassed $3 billion, with more than 300 deals closing in 2022 alone. Investors raced to enter the space after Procore’s 2021 IPO validated the potential for venture-sized returns in construction technology. This was the “big break” ConTech had been waiting for, prompting FOMO among major firms like Sequoia and a16z. Following the broader tech bubble burst in late 2022, AEC tech funding dipped over the next two years. While some view this as a negative development, it largely reflects a return to more realistic market conditions. Given the boom-and-bust nature of tech, few were surprised by this correction.

Despite the economic downturn, AEC tech deal sizes have steadily increased, especially for early-stage rounds. By 2024, the median seed investment exceeded $2 million, while median Series A deals have hovered just above $8 million for the past three years. This trend signals a positive environment for investment, as larger raises fuel startups to scale more rapidly.

In 2024, AEC tech ended the year with just under $2 billion in total investment—slightly above 2018 levels. Early estimates for 2025 suggest a modestly bullish outlook, with funding potentially remaining flat or edging above $2 billion. This figure is still minimal compared to established verticals like PropTech, which draws around $10 billion annually. Indeed, AEC represents only about 1% of total venture dollars each year. However, the sector’s high annual growth rate continues to intrigue many investors.

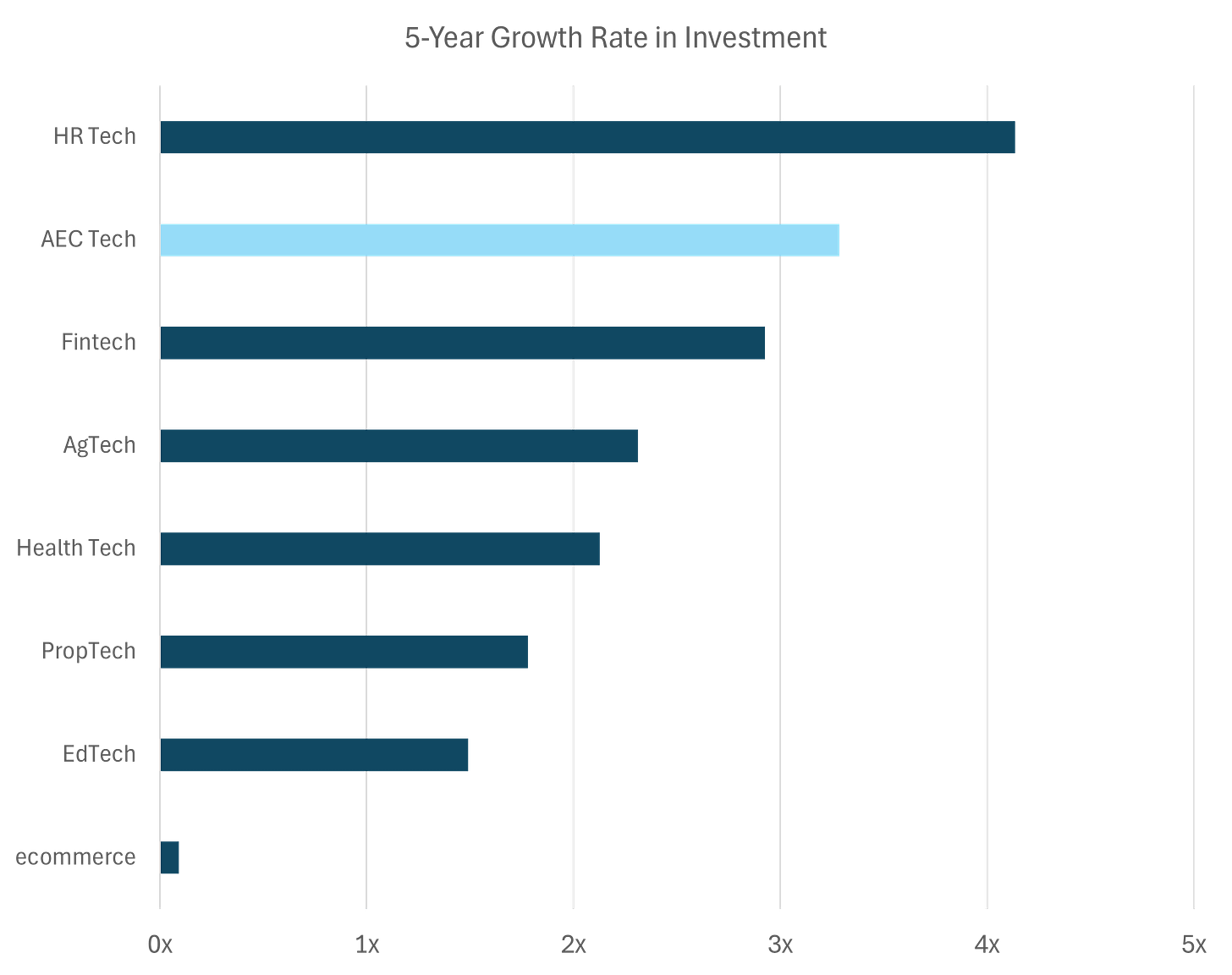

Over a five-year period (2017-2022), AEC tech investment has grown by 3.3x, outstripping established sectors like healthtech, fintech, and even proptech. Venture firms often prioritize emerging opportunities—those “hidden gems” that can become tomorrow’s breakout successes. With such a notable growth rate, the built world may be the next major vertical ripe for disruption.

While the growth rate of venture investment is a key indicator, market size remains crucial. An industry’s overall size often corresponds to the potential market for any technology that aims to disrupt it. Consider healthcare: it’s among the largest global sectors—and rightfully so, given health’s place at the top of our hierarchy of needs. Because healthcare is so vast, healthtech likewise commands significant investment activity.

Let’s compare AEC to another long-standing B2B industry—FinTech. By applying the same logic, we see that financial services represents a $25 trillion global market, with about $500 billion in cumulative venture funding—2% of that industry’s value. Meanwhile, construction’s market size is estimated at $15 trillion, yet total venture funding in AEC technology is only around $35 billion, or 0.2% of the market. Clearly, AEC has plenty of room to grow. Although the sector got a later start compared with finance, it’s likely only a matter of time before it closes the gap.

A Deep Dive into AEC Tech’s Notable Exits

Having established the current state of AEC tech, let’s examine some specific venture deals in this space. Most VC funds are judged primarily on two metrics:

Total Return Multiple: The ratio of total return to the initial investment (e.g., turning $10 million into $30 million is a 3x return).

Internal Rate of Return (IRR): The annualized compounded rate that aligns present cash outflows and future inflows (e.g., investing $10 million at Series A and exiting at $30 million eight years later equates to a ~14.7% IRR).

To learn more on venture capital metrics, check out this article by Roundtable.

We’ll adopt the lens of an early-stage investor (Series A) for these case studies. While these deals may represent outliers, they showcase the sector’s upside potential. Since venture funds are often measured by home-run outcomes, these examples offer a telling glimpse of what’s possible. One final note: because not all venture data is publicly disclosed, certain assumptions were necessary to conduct this analysis effectively.

Autodesk Acquisition of PlanGrid (2018):

Founded in 2011 in San Francisco, PlanGrid was among the earliest SaaS platforms for construction project management. At the time, Procore was quickly solidifying its position as the recognized market leader, prompting incumbents such as Autodesk, Trimble, and Hilti to seek ways to stay competitive.

PlanGrid joined Y Combinator in Winter 2012, raising a seed round that included prominent investors like Sam Altman. In May 2015, they secured $18 million in a Series A round led exclusively by Sequoia at a presumed $90 million valuation (about 20% equity for Sequoia). By 2018, Autodesk acquired PlanGrid for $875 million, delivering Sequoia a roughly 10x return within three and a half years—an admirable ~77% IRR.

Procore IPO (2021):

Procore is widely considered the poster child of construction technology. They are well-known across the industry and generally well-regarded (except the customers subject to their exorbitant project-based pricing).

Procore, considered the flagship name in construction software, took a notoriously gradual path to success. Founded in 2002 in Carpinteria, CA, it operated largely with angel funding for over a decade—a red flag for some VCs wary of long horizons. Finally, by 2014, Bessemer Venture Partners led a $15 million Series A at a post-money valuation of $75 million (likely 20% equity for Bessemer). Seven years later, Procore IPO’d at an $11 billion valuation, implying a 100x multiple for Bessemer—or around a 96% IRR over that period.

Hilti Acquisition of Fieldwire (2021):

Founded in 2013 by two engineers, Fieldwire was positioned to tackle jobsite coordination and task management in construction—an area often neglected by existing project management tools. Headquartered in San Francisco, the company joined startup accelerator AngelPad, then promptly raised a $1.1 million seed round in 2015. A notable investor in that seed round was Brick & Mortar Ventures, led by Darren Bechtel of the Bechtel construction family.

Two years later, Fieldwire closed a $6.6 million Series A led by Menlo Ventures at a reported $25 million valuation, with Brick & Mortar returning pro rata. Subsequent Series B and C rounds followed in 2019 and 2020, respectively, each featuring Brick & Mortar. Finally, in late 2021, Hilti acquired Fieldwire for $300 million. For Brick & Mortar, which likely maintained its ownership through multiple rounds, the deal delivered an estimated 3.8x multiple and roughly a 92% IRR on its cumulative investment.

Oracle Acquisition of Aconex (2017):

Aconex was founded in 2000 in Melbourne, Australia, with a vision to provide an end-to-end collaboration and document management platform for construction projects worldwide. Unlike many Silicon Valley startups, Aconex stayed closer to home and relied on angel funding during its early years, growing steadily with minimal outside capital.

By 2006, Aconex raised a $5.6 million Series A led by Starfish Ventures, an Australian fund that likely took around 10% equity. Surviving the 2008 financial crisis, the company continued to expand internationally and eventually IPO’d on the Australian Securities Exchange in 2014 at a $312 million valuation. Starfish presumably retained its stake through the Oracle acquisition in 2017, which closed at roughly $1.2 billion. The outcome represented an estimated 40x multiple for Starfish and an ~11-year journey that equated to a ~40% IRR.

Comparing AEC to Leading Software Exits:

In order to see how these AEC deals measure up against broader tech benchmarks, let’s compare the four AEC examples with other top-tier B2B tech outcomes. Stacking these four exits against other notable tech outcomes, we see that Procore, Fieldwire, and PlanGrid boast IRRs exceeding those of many established tech players, trailing only blockbuster IPOs like Zoom or Datadog. Their ~80% annual returns essentially double the top-quartile average of 40% across all VC deals, while Aconex’s ~40% IRR still meets top-quartile criteria despite a longer road to acquisition.

In terms of total return multiple, they also fare quite well. Procore, as an IPO, sits comfortably above Adobe’s $4.75 billion acquisition of Marketo and just below Slack’s $20 billion public valuation. Nearly all four deals exceed the average VC multiple of 4x, except Fieldwire, which saw a modest acquisition price relative to its Series A price tag.

Regardless, AEC tech can hold its own next to the wider tech industry. While venture exits in AEC remain less frequent, they can generate robust returns when they do occur. Indeed, only five AEC companies have ever gone public—Autodesk, Trimble, Bentley, Procore, and now ServiceTitan. Though IPOs are infrequent, incumbents such as Autodesk, Trimble, and Procore are eager to buy their way into innovation. In fact, these three giants have collectively executed over 30 acquisitions in the past decade, providing ample opportunities for VCs to return capital to partners at above-average rates.

Emerging Opportunities in AEC Tech

Looking ahead, the AEC venture market appears poised for further expansion. There are currently 19 AEC tech unicorns worldwide, collectively valued at around $45 billion—an impressive count compared to other B2B verticals. By contrast, HR tech reports about 15 unicorns, while healthtech (which captures roughly 15% of all VC funding) has 85.

Not only are there a significant proportion of unicorns in AEC but they are also globally diverse. Of the 19 unicorns, only 11 are in North America, 7 in China/India, and 1 in Europe. Generally, startups have a much higher concentration in the US but AEC has specific nuance that allows it to become more active globally. Europe, for example, puts a heavier emphasis on green/climate tech which has a heavy overlap with AEC tech. India and China on the other hand, have a faster growing infrastructure market than North America, allowing for more capital to flow into technology. As a result, certain VC firms—like Foundamental, 2024’s top investor by Built Worlds—have embraced cross-border strategies to capitalize on this fragmentation.

There are not only many unicorns in AEC but also dozens of promising early-to-mid size startups with very strong backing. Built Robotics backed by Founders Fund, Snaptrude backed by Accel, Trunk Tools backed by Redpoint, and Doxel backed by a16z. The renowned accelerator, Y Combinator, which first accepted an AEC-focused company in 2012 (PlanGrid), has since averaged five AEC startups per year over the past six years. Startups are eager to transform the massive construction industry and investors are itching to write checks.

Currently, the AEC tech investment space has a heavy proportion of corporate venture capital (CVC) funding. These come from both corporate strategic incumbent funds like Trimble Ventures and industry innovation departments like Suffolk Technologies. Roughly 1 in 4 venture deals involve a corporate venture capital fund within the AEC tech space. CVCs typically offer startups quick access to a plethora of construction customers and integration pathways that can dramatically accelerate product adoption.

Investment Justification Conclusion

So, is AEC tech worth the investment? The data suggests an emphatic yes. Construction’s enormous market size, coupled with minimal technology penetration, presents significant room for upside. Discounting macroeconomic volatility, the AEC venture landscape is steadily maturing in both deal volume and total funding. With over a dozen unicorns, robust early-stage activity, and proven exit returns, the sector is increasingly matching the excitement around giants like fintech and proptech. In short, the future for AEC tech looks remarkably promising—and if I were an investor, I’d certainly want to join the party.